If you are a taxi, private hire, courier, delivery driver, chauffeur, or driving instructor, doing your accounts and tax returns are now a whole lot simpler and faster. Simply enter your income and expenses, hit submit and your tax return is done!

We’re HMRC recognised and you’ll save money on accountancy fees.

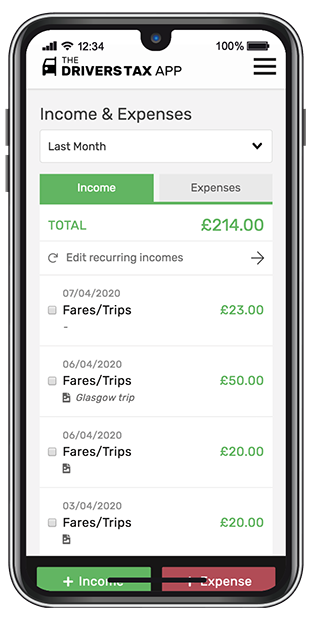

- Simply add your receipts and expenses

- The Drivers Tax app will produce your tax return

- Hit submit and it gets sent straight to HMRC

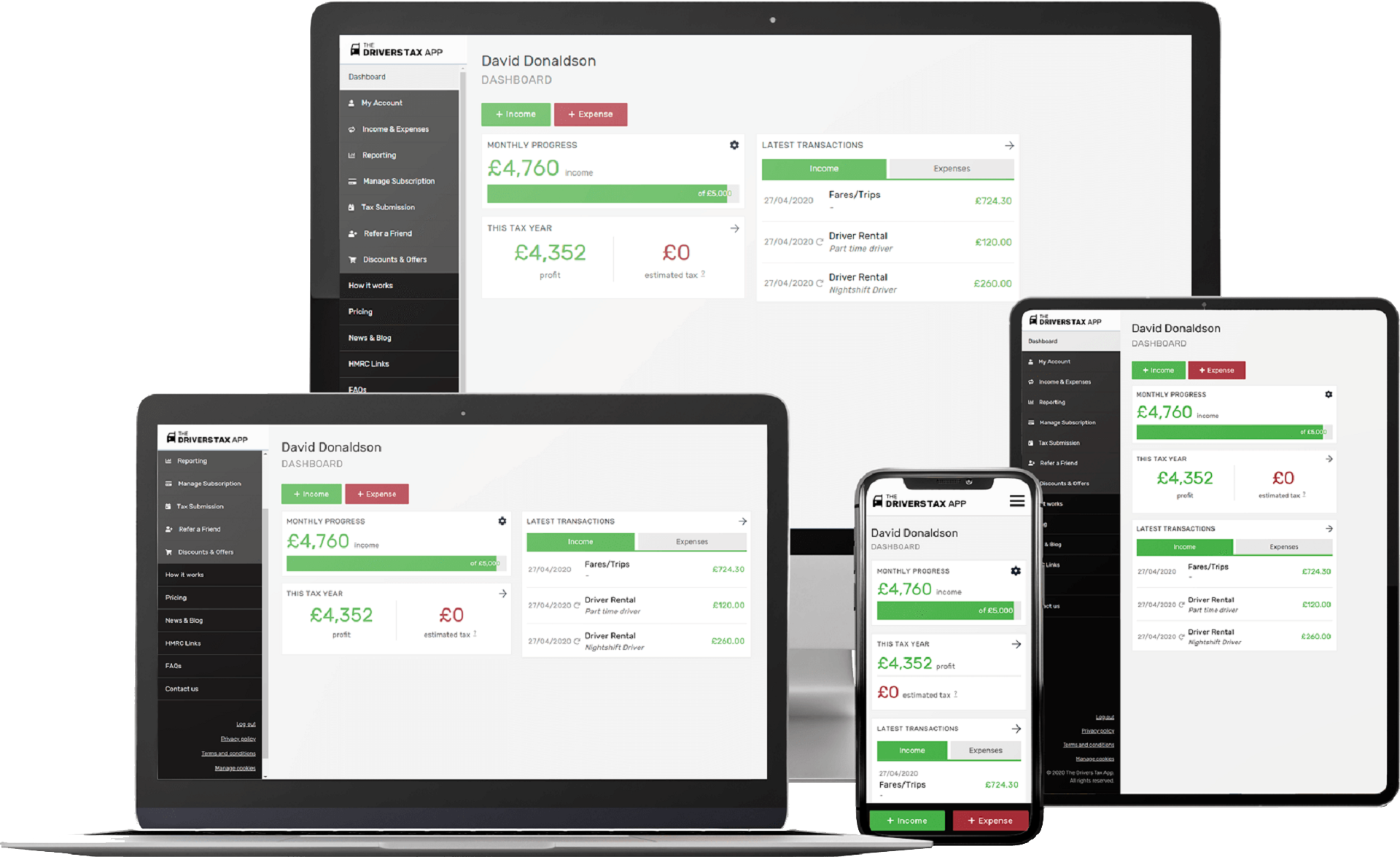

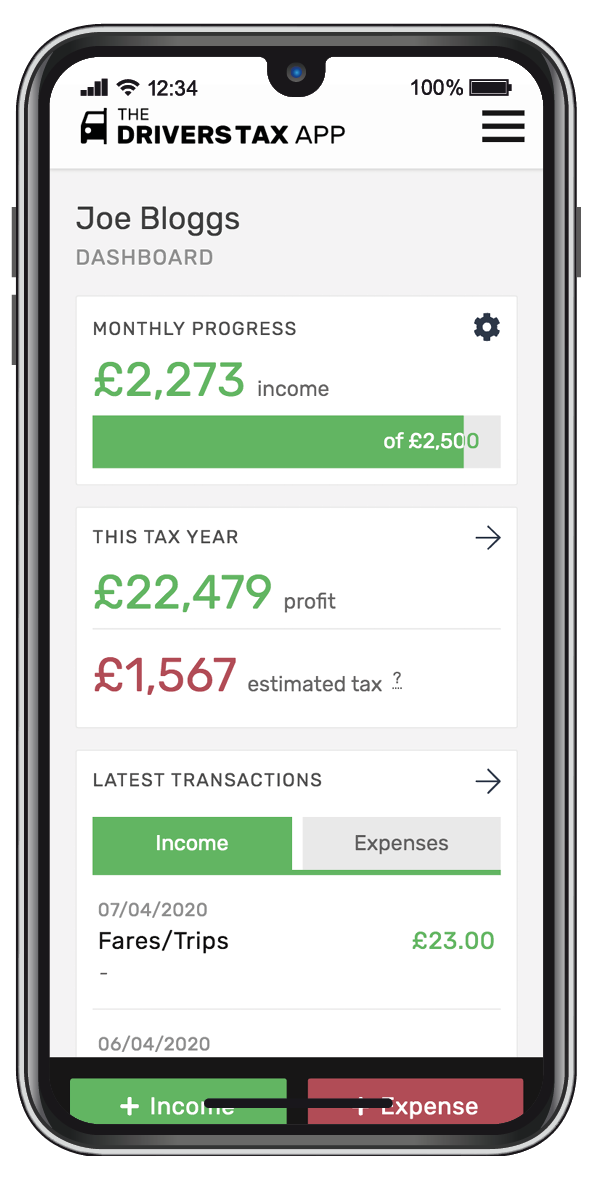

- At a glance dashboard

- Compare income streams & previous years’ performances

- Try before you buy with our 30 day free trial

New HMRC tax rules for professional drivers

Making Tax Digital means that you will have to submit four tax returns and a crystallisation statement every year. If you are a taxi driver you’ll have to provide your tax return confirmation in order to have your licence renewed. With four tax returns required a year that’s a lot of accountant fees with the average accountant charging £350 for one return.

The Drivers Tax App produces and submits a done-for-you tax return for as little as £9.79 per month. You can track your earnings, snap and store receipts, see what you owe in tax and NIC and submit your tax return straight to HMRC.

Save time and money. Get peace of mind. Your tax sorted.

People are diggin’ it

Our pricing

BASIC

£5.79 / month ?If you juin us mid-year, a balancing payment for any unpaid months will be required before you can submit your tax return.

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PRO

£9.79 / month ?If you juin us mid-year, a balancing payment for any unpaid months will be required before you can submit your tax return.

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PREMIUM

£19.79 / month ?If you juin us mid-year, a balancing payment for any unpaid months will be required before you can submit your tax return.

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover (coming soon)

BASIC

£60 / year

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PRO

£100 / year

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PREMIUM

£200 / year

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover (coming soon)

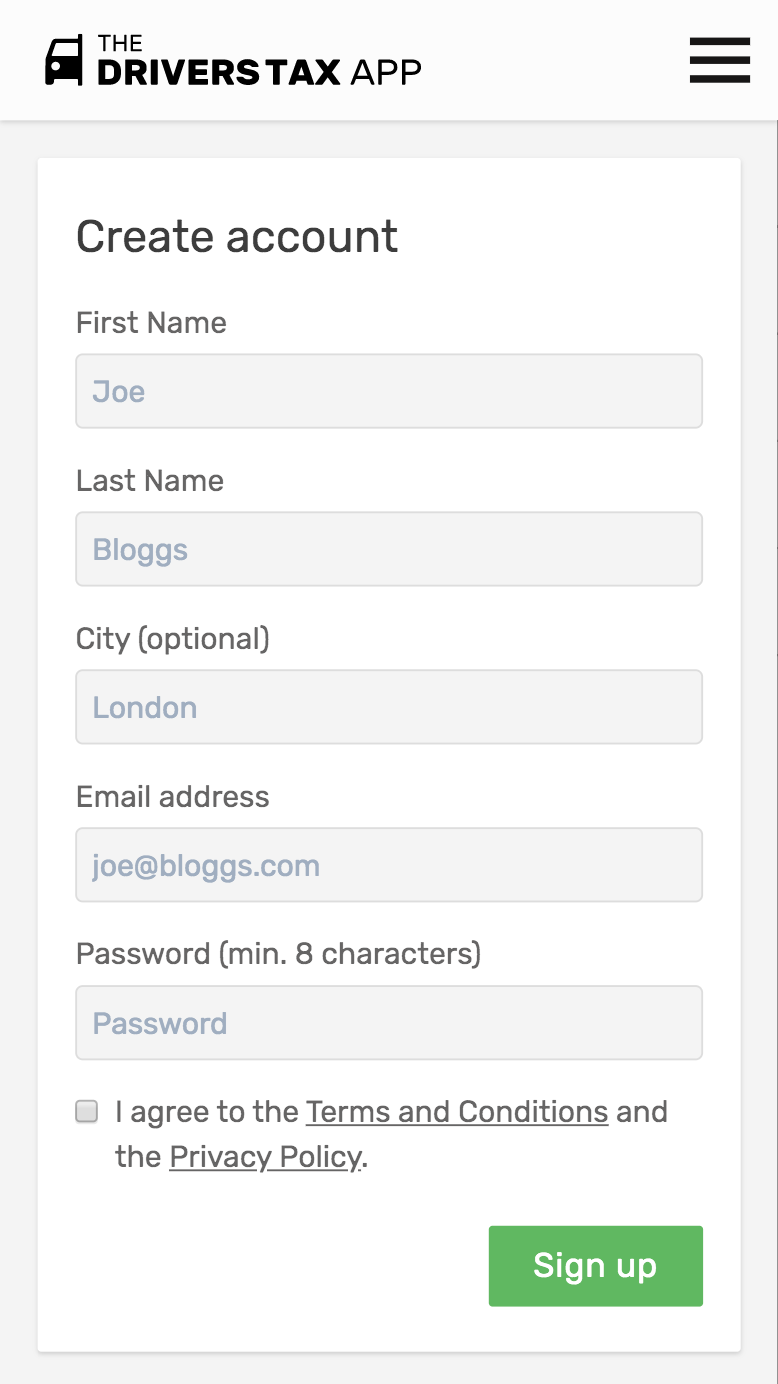

We’re a web-based app

That means you won’t find us in any app store.

Just go to the website www.thedriverstaxapp.com, and log in.

The benefit is that you can log in from any device, and it won’t use any storage space on your phone.

Got a question?

Email: [email protected]

© 2021 Tax App | Privacy Policy